Services

Areas of Expertise

Artificial Intelligence

Optimization and Acceleration with AI

DevOps

Frictionless development workflows

Cloud Solutions

Operational optimization

Digital Transformation

Evolve with software development

Big Data & Analytics

Gain competitive advantages

Digital Commerce

Enhance the shopping experience

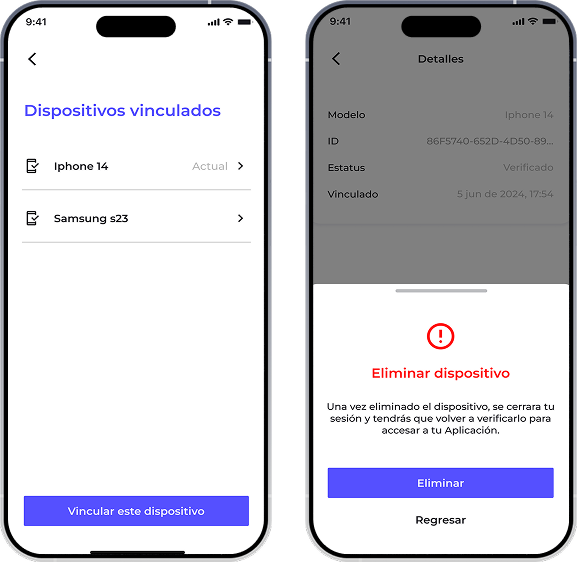

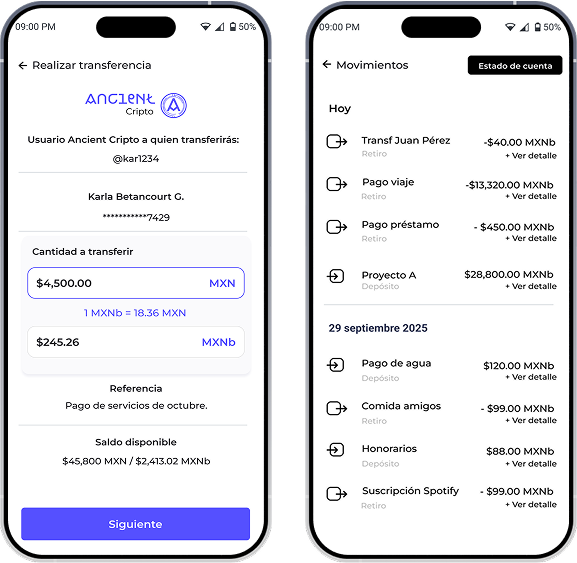

Blockchain

Transparency and security

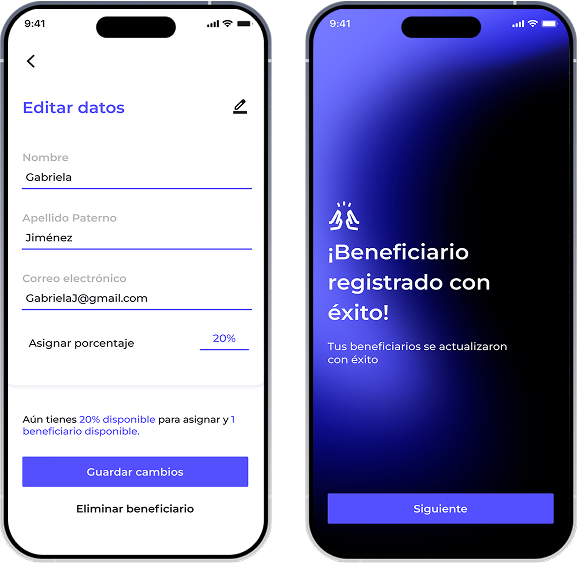

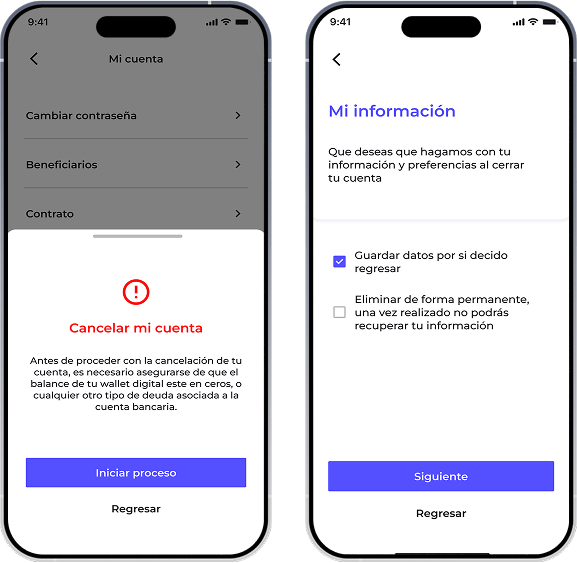

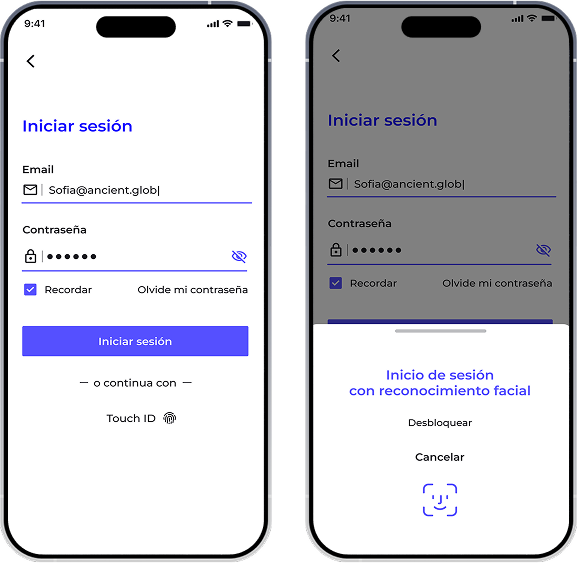

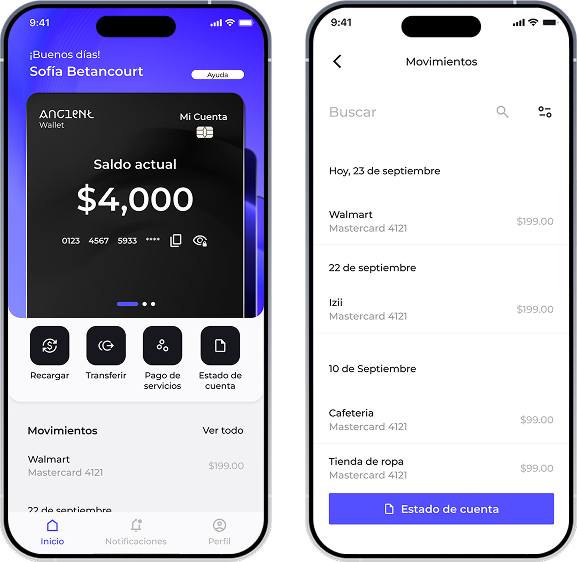

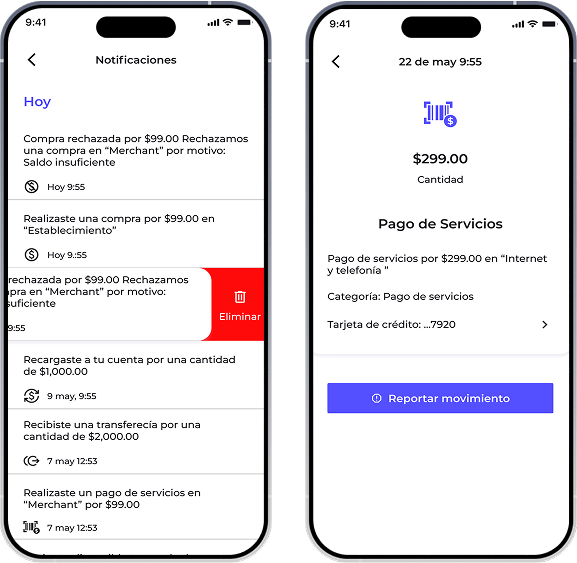

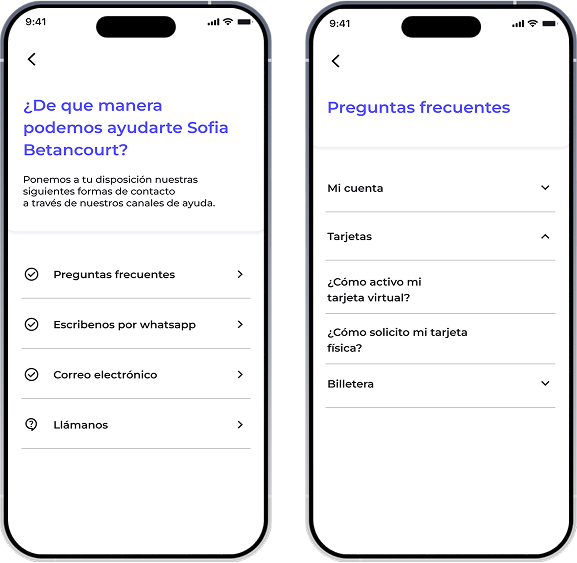

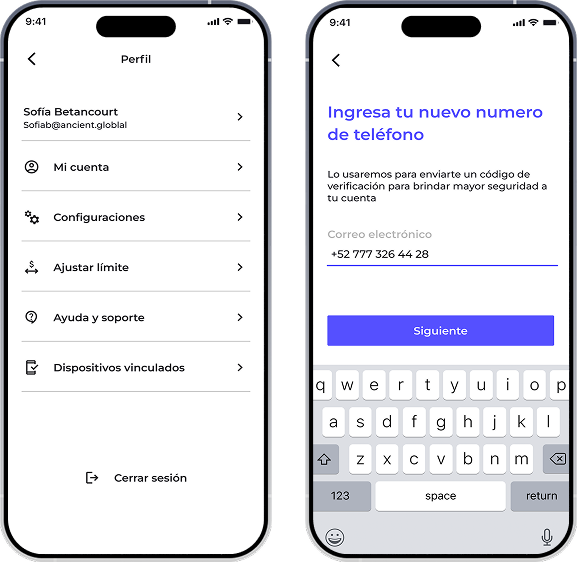

UX/UI

Intuitive experiences

Industries

Fintech & Banking

Central banking and payment systems

Insurtech / Insurance

Solutions for insurance companies

Telecommunications

Accelerating communication

Service Models

IT Staffing

Skilled personnel for your company

Software Outsourcing

Efficiency, innovation, and cost reduction

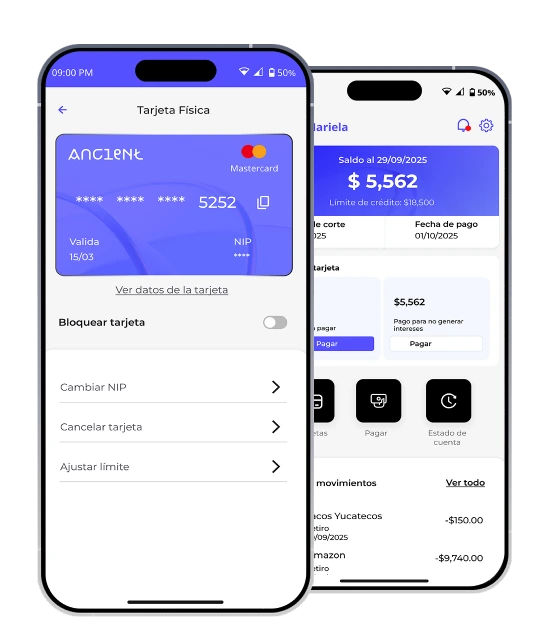

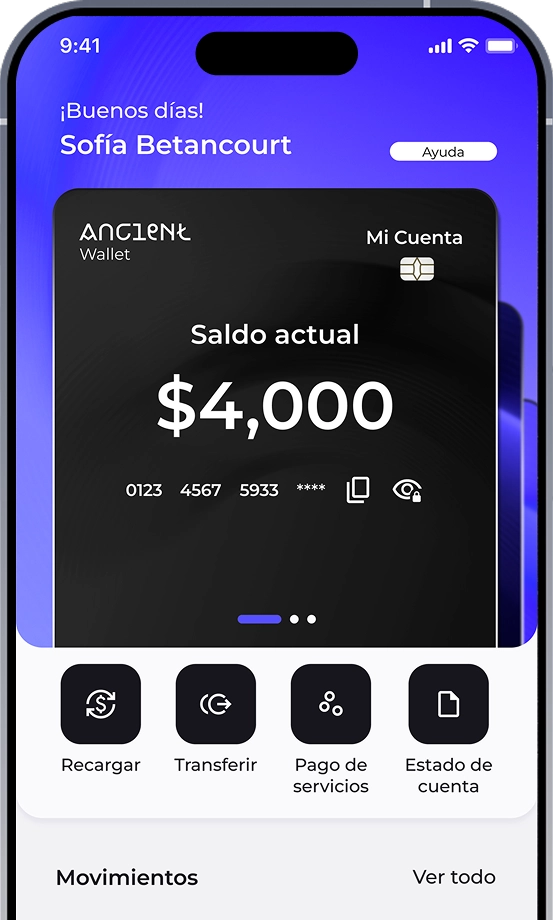

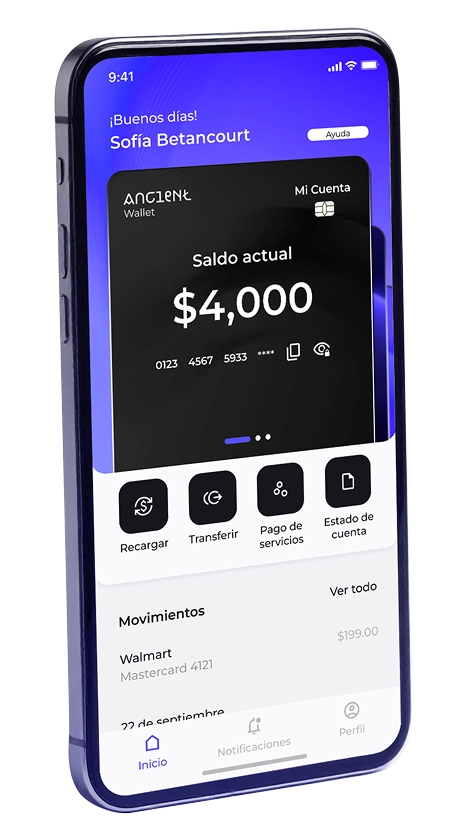

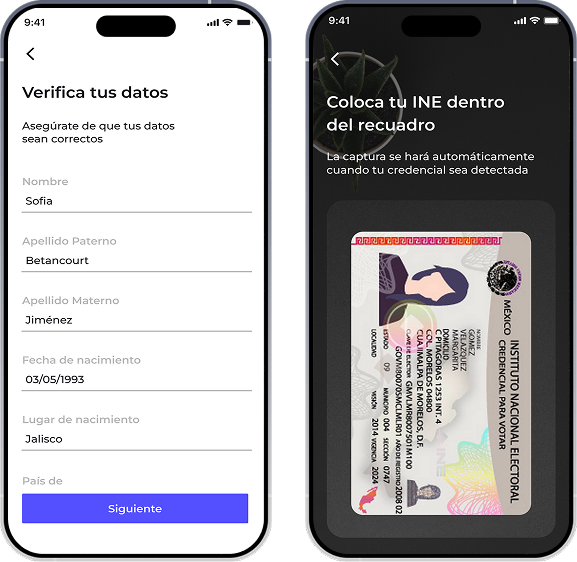

Fintech products

Digital solution for your finances and payments.

Ancient

About Ancient

We honor ancestral wisdom

Certifications and Awards

Industry recognition

Success Stories

Proven solutions. Real impact.

Values and Social Responsibility

The principles that inspire and guide us